Lane Health and Teledentistry.com Announce a Strategic Partnership to Revolutionize Dental Healthcare Financing

Transforming the way patients manage and finance their dental and other healthcare expenses

NORFOLK, VIRGINIA, UNITED STATES, May 21, 2024 /EINPresswire.com/

In a groundbreaking alliance, Lane Health, a leader in healthcare financing technology, has teamed up with Teledentistry.com, a pioneer in digital dental practice and aggregation, to present the Healthcare Spending Card1 to Teledentistry.com patients. This strategic partnership will transform the way patients manage and finance their dental and other healthcare expenses, providing an important financial well-being tool that can help ensure people don’t have to delay or forego necessary healthcare services.

According to a 2022 KFF poll, which looked at the specific types of care adults are most likely to report putting off, dental services are the most common types of medical care that people report delaying or skipping, with 35% of adults saying they have put it off in the past year due to cost.

"Our mission has always been clear," says Scott Beck, Chief Revenue Officer of Lane Health. "We want to help people afford and access the care they deserve by helping to remove barriers to cost. Our collaboration with Teledentistry.com is a significant leap forward in that direction."

Teledentistry.com has been at the forefront of integrating dental care with the latest technology, ensuring that high-quality dental services reach a broader audience through digital means. "We're not just treating teeth; we're treating people. And in this digital age, that means meeting them where they are - online," states Dr. Vilas Sastry, CEO of Teledentistry.com. "Working alongside Lane Health, we are excited to present our patients a seamless experience that combines our digital dental expertise with innovative financial solutions."

This partnership is poised to offer an unprecedented model of care in the dental industry, where the convenience of teledentistry meets the flexibility of FinTech. By joining forces, Lane Health and Teledentistry.com aim to remove financial barriers to dental and other healthcare expenses, helping enable patients to receive timely treatments without the stress of managing costs.

The partnership will leverage Lane Health's innovative solutions, to integrate seamless payment options into Teledentistry.com's platform, creating a user-friendly interface for patients to finance dental care. With a shared commitment to excellence and innovation, both organizations are dedicated to bringing their best to their clients and patients.

About Lane Health:

Lane Health, with its unique position at the intersection of FinTech and Healthcare, provides innovative financial solutions designed to

make healthcare management an empowering experience. For more information about Lane Health, visit www.lanehealth.com.

About Teledentistry.com:

As a leader in the digital dentistry space, Teledentistry.com connects patients with licensed dentists via online consultations, making dental care more accessible than ever. Learn more about Teledentistry.com's digital dental solutions at www.teledentistry.com.

_____________

1 Lane Health is a financial technology company, not a bank. The Healthcare Spending Card is issued by Lead Bank.

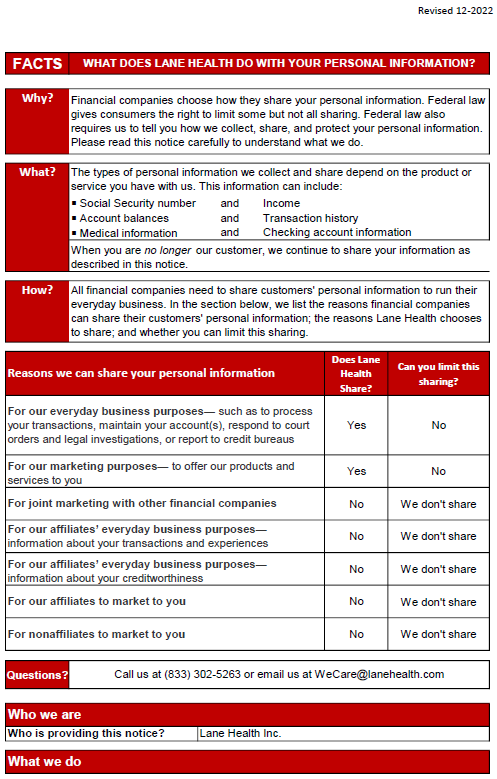

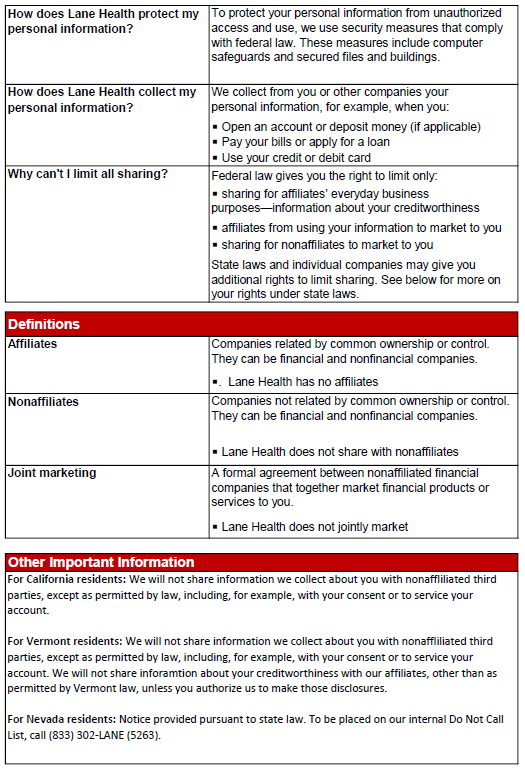

We recognize and respect the privacy expectations of today’s consumers and the requirements of applicable federal and state privacy laws. We believe that making you aware of how we use your non-public personal Information (“Personal Information”), and to whom it is disclosed, will form the basis for a relationship of trust between us and the public that we serve. This Privacy Statement provides that explanation. We reserve the right to change this Privacy Statement from time to time consistent with applicable privacy laws.

In the course of our business, we may collect Personal Information about you from the following sources:

- From applications or other forms we receive from you or your authorized representative

- From your transactions with, or from the services performed by, us, our affiliates, or others

- From our internet web sites

- From the public records maintained by governmental entities that we either obtain directly from those entities, or from our affiliates or others

- From consumer or other reporting agencies

Our Policies Regarding the Protection of the Confidentiality and Security of Your Personal Information

We maintain physical, electronic and procedural safeguards to protect your Personal Information from unauthorized access or intrusion. We limit access to the Personal Information only to those employees, contractors and agents who need such access in connection with providing products or services to you or for other legitimate business purposes. We will at all times comply with all laws and regulations to which we are subject regarding the collection, use and disclosure of individually identifiable Information.

Our Policies and Practices Regarding the Sharing of Your Personal Information

We may share your Personal Information with our affiliates. We also may disclose your Personal Information to:

- Agents, brokers or representatives to provide you with services you have requested

- Third-party contractors or service providers who provide services or perform marketing or other functions on our behalf

- Governmental entities to meet our legal requirements connected to the collection, retention and disclosure of individually identifiable

- Information, such as tax reporting or identification of money laundering

- Law enforcement in connection with investigations, or civil or criminal subpoenas or court orders

In addition, we will disclose your Personal Information when you direct or give us permission, when we are required by law to do so, or when we suspect fraudulent or criminal activities. We also may disclose your Personal Information when otherwise permitted by applicable privacy laws such as, for example, when disclosure is needed to enforce our rights arising out of any agreement, transaction or relationship with you.

Certain states afford you the right to access your Personal Information and, under certain circumstances, to find out to whom your Personal Information has been disclosed. Also, certain states and the Safe Harbor principles afford you the right to request correction, amendment or deletion of your Personal Information. We reserve the right, where permitted by law, to charge a reasonable fee to cover the costs incurred in responding to such requests.

All requests must be made in writing to the following address:

440 Monticello Ave

Ste 1802 PMB 61161

Norfolk, VA 23510

1. Policy Overview

This document (“Policy”) governs the oversight of the whistleblower process utilized by Lane Health in connection with protecting individuals who report activities believed to be illegal, dishonest, unethical, or otherwise improper.

1.1. Purpose

The purpose of the Policy is to ensure that the risks related to whistleblower activities are understood and managed in a systematic fashion that is compliant with Lane Health policy, applicable laws, regulations and guidance, and serves the best interests of Lane Health, shareholders and customers.

1.2. Scope

This Policy applies to all report activities believed to be illegal, dishonest, unethical, or otherwise improper.

1.3. Definitions

The following definition should be used when reviewing this policy:

Whistleblower is defined by this policy as an employee who reports, to one or more of the parties specified in this policy, an activity that he/she considers to be illegal, dishonest, unethical, or otherwise improper.

Employee or public employee means a person who performs a service for wages or other remuneration under a contract of hire, written or oral, express, or implied, for the district.

Matter of public concern means:

- a violation of a state, federal, or municipal law, regulation, or ordinance;

- a danger to public health or safety; and/or

- gross mismanagement, substantial waste of funds, or a clear abuse of authority.

1.4. Compliance

Lane Health will comply with all applicable laws, regulations and guidance pertaining to whistleblowers for regulated financial institutions.

2. Program Governance

See the CMS Policy for information related to Program Governance, including roles and responsibilities.

3. Policy Elements

The expectation and guidance shown below constitute a high-level overview of the standards Lane Health will use when made aware of potential whistleblower complaints.

5.1 General

- The organization will not retaliate against a whistleblower. This includes, but is not limited to, protection from retaliation in the form of an adverse employment action such as termination, compensation decreases, or poor work assignments and threats of physical harm. Any whistleblower who believes he/she is being retaliated against must contact the Chief Compliance Officer immediately. The right of a whistleblower for protection against retaliation does not include immunity for any personal wrongdoing that is alleged and investigated.

- Whistleblower protections are provided in two important areas: confidentiality and retaliation. Insofar as possible, the confidentiality of the whistleblower will be maintained. However, identity may have to be disclosed to conduct a thorough investigation, to comply with the law, and to provide accused individuals their legal rights of defense.

- Individuals protected include:

- the employee, or a person acting on behalf of the employee, who reports to a public body or is about to report to a public body a matter of public concern; or

- the employee who participates in a court action, an investigation, a hearing, or an inquiry held by a public body on a matter of public concern.

- The organization may not discharge, threaten, or otherwise discriminate against an employee regarding the employee’s compensation, terms, conditions, location, or privileges of employment.

- The organization may not disqualify an employee or other person who brings a matter of public concern, or participates in a proceeding connected with a matter of public concern, before a public body or court, because of the report or participation, from eligibility to bid on contracts with the organization; receive land under a district ordinance; or receive another right, privilege, or benefit.

- The provisions of this policy do not:

- require the organization to compensate an employee for participation in a court action or in an investigation, hearing, or inquiry by a public body;

- prohibit the organization from compensating an employee for participation in a court action or in an investigation, hearing, or inquiry by a public body;

- authorize the disclosure of information that is legally required to be kept confidential; or

- diminish or impair the rights of an employee under a collective bargaining agreement.

- Limitation to protections:

- A person is not entitled to the protections under this policy unless he or she reasonably believes that the information reported is, or is about to become, a matter of public concern; and reports the information in good faith.

- A person is entitled to the protections under this policy only if the matter of public concern is not the result of conduct by the individual seeking protection, unless it is the result of conduct by the person that was required by his or her employer.

- Before an employee initiates a report to a public body on a matter of public concern under this policy, the employee shall submit a written report concerning the matter to the organization’s Chief Compliance Officer. However, the employee is not required to submit a written report if he or she believes with reasonable certainty that the activity, policy, or practice is already known to the Chief Compliance Officer; or that an emergency is involved.

5.2 Procedures

- If an employee has knowledge of or a concern of illegal or dishonest/fraudulent activity, the employee is to contact his/her immediate supervisor or the Chief Compliance Officer. All reports or concerns of illegal and dishonest activities will be promptly submitted by the receiving supervisor to the Chief Compliance Officer, who is responsible for investigating and coordinating any necessary corrective action. Any concerns involving the Chief Compliance Officer should be reported to the Chief Executive Officer.

- The whistleblower is not responsible for investigating the alleged illegal or dishonest activity, or for determining fault or corrective measures; appropriate management officials are charged with these responsibilities.

- Examples of illegal or dishonest activities include violations of federal, state, or local laws; billing for services not performed or for goods not delivered; and other fraudulent financial reporting. The employee must exercise sound judgment to avoid baseless allegations. An employee who intentionally files a false report of wrongdoing will be subject to disciplinary action.

6. Policy Operations

See associated procedures for additional requirements related to the day-to-day processes to ensure compliance with this Policy.

7. Policy Exceptions

See the CMS Policy for information related to Policy Exceptions.

Submitting whistleblower claims:Claims can be submitted to a restricted email: whistleblower@lanehealth.com

Guiding Principles

At Lane Health, we strive to provide services to our customers in a secure and responsible manner. As we built an industry only pre-tax and post-tax lending platform, HSA and other benefits administration solutions, as well as customer facing web and mobile interfaces, we’ve done it with security built into the architecture and our processes. Lane Health is committed to protecting the confidential information, data integrity, and transparency of our operations.

This page goes over our approach to securing PII against cyber-attacks—combining secure design and quality engineering practices, developing strong connections with the cybersecurity community, and developing a world-class Risk & Compliance process.

Cybersecurity

Lane Health follows industry accepted best practices when it comes to security. We established joined internal operations between SREs, NOC and Software Engineering teams to implement and deploy controls designed to secure the perimeter of our systems and minimize the threat of attacks.

Fraud Prevention

Our Fraud Prevention Operation is employing the best practices of fraud prevention and cybersecurity monitoring through rigorous security training and systematic monitoring to identify and secure the data of our clients.

Compliance

Lane Health Compliance department operates at the enterprise level: managing operational, financial, and security risks for the entire company. They interface with internal and external audit entities and implement state of the industry transparent operation.

Incident Management and Communication

Lane Health created a robust Incident Management and Communication policy that was certified by our banking institution.

Privacy

Lane Health developed the Data Privacy policy based on the detailed analysis of government regulations and validated by rigorous audits. Our state-of-the-art technology teams build systems with security and privacy in mind. The Privacy Policy can be found here: /resources#nav-documents

Lane Health Security Features:

- Regular 3rd-party vulnerability scanning and testing

- Dynamic capacity and scalability management

- Intrusion detection monitoring

- Multiple redundant data centers

- Annual review of policies

- Call centers with high responsiveness SLA

- All employees and contractors with access to Lane Health systems and data complete mandatory compliance, privacy, and security training as part of hiring process

- Third party verification of cloud-native architecture for Health Insurance Portability and Accountability Act (HIPAA) compliance

- Background checks for US employees with access to PII

Security and Vulnerability Reporting

Lane Health encourages security researchers to report discovered issues with Lane Health systems by reporting them to securityreporting@lanehealth.com.

* Subject to credit line approval.

1 Lane Health is a financial technology company, not a bank. The Healthcare Spending Card is issued by Lead Bank pursuant to a license from Visa USA Inc.

2 Lane Health does not charge interest on, or an annual fee for, the Healthcare Spending Card. “0% financing” pertains to repayment options that do not charge interest (0% interest) nor fees ($0 fees). Each Advance can be repaid in full, 4-month term or 12-month term (with a minimum $3 due each payment period). Transactions other than qualified hospital expenses (based on merchant category code) will be charged an origination fee of 5% and periodic finance fees. The location of the service provider is not determinative of whether a transaction is a qualified hospital expense. Rather, transactions made within or at a hospital (including but not limited to specialists, doctors, pharmacies, etcetera) are determined to be eligible by the associated MCC and not the location of the service provider in the hospital. New Advances, if eligible, can be repaid in full or over 4 installments with no origination or periodic finance fees. Late fees apply. You can review the fee table at https://lanehealth.com/hsc-lb-fees

All your questions answered!

The Advance line of credit is a new source of financial protection and bill paying capacity for your qualified healthcare expenses. Lane Health offers two types of the Advance line of credit: (1) an Advance line of credit for those employees enrolled in a Health Savings Account (HSA), and (2) an Advance line of credit for those not enrolled in an HSA.

With most HSAs, you can only pay qualified healthcare bills with money you have contributed and saved in your HSA. With Lane Health’s HSA Advance line of credit, you can pay those bills through your HSA anytime up to your Advance Limit. See below for how the HSA Advance line of credit works.

For those without an HSA, you can also use your Advance line of credit to pay qualified healthcare bills you are responsible for. See below for how the non-HSA Advance line of credit works.

Advances are issued by WebBank, Member FDIC.

Your Advance line of credit will be available to you at the beginning of the year (your “Advance Limit”), based on several factors (primarily your length of employment and income). After you activate the Advance line of credit, simply swipe your Card with a Heart when you need to pay a qualified healthcare bill. The cash you have in your HSA account is used to pay the bill first. If you need more, the funds will automatically be advanced up to your Advance Limit. The pre-tax HSA payroll deduction required to repay the Advance and associated fees is calculated over the following 12 months and the new deduction amount is communicated to you and your payroll provider. It’s simple, convenient and doesn’t require you to do anything other than focus on getting the care you need.

With the non-HSA Advance line of credit, you repay the Advance and associated fees through after-tax (not pre-tax) payroll deductions. You still receive an Advance Limit at the beginning of the year. After you activate the Advance, simply swipe your Card with a Heart when you need to pay a qualified healthcare bill. Funds you have available in other spending accounts such as an FSA are used first to pay the bill. If you need more, the funds will automatically be advanced up to your Advance Limit. The after-tax payroll deduction required to repay the Advance and associated fees is calculated over the following 12 months and the new deduction amount is communicated to you and your payroll provider. It’s simple, convenient and doesn’t require you to do anything other than focus on getting the care you need.

We will send you a Welcome Letter prior to the beginning of the year that includes instructions on how to activate the Advance line of credit and receive your Advance Limit. Once activated, you can go on your Lane Health portal (BeWell.lanehealth.com) at any time to see the status of your Advances – amount available, amount outstanding, payroll deduction amount, and remaining payroll periods to pay-off.

Once activated, Advances are available to you on the first day of your health plan eligibility and remain available throughout the entire year. You can receive multiple Advances up to your Advance Limit. It’s there for you when you need it.

No, we do not pull a credit report to set your initial Advance Limit.

No! Just swipe your Card with a Heart and if you need an Advance to pay the healthcare bill, the Advance Is automatically issued up to your Advance Limit! It’s simple and easy!

The Advance line of credit must be activated by you to be available so if you don’t want any Advances, simply choose to not activate it. If you activated it and later decide you don’t want any further Advances, you can opt-out at any time by going to the member portal (BeWell.lanehealth.com) or calling us at (833) 302-LANE (5263) and your Advance line of credit will be de-activated.

You are responsible for repayment of the Advance even if you are leaving your current employer. If during activation you opted out of settling the Advance via your final paycheck or if your final paycheck is insufficient to cover your outstanding balance, you are responsible to contact us and set up a repayment plan for the remaining balance.

Your tax-free HSA funds can be used on a wide variety of medical, dental, and vision expenses. You can see a list of common HSA-qualified healthcare expenses here.

If you have questions, you can email them to WeCare@lanehealth.com. You can also call our customer service center at 833-302-LANE (5263).

HSA Advance Line of Credit Overview

Employee Overview

Solutions Overview

We recognize and respect the privacy expectations of today’s consumers and the requirements of applicable federal and state privacy laws. We believe that making you aware of how we use your non-public personal Information (“Personal Information”), and to whom it is disclosed, will form the basis for a relationship of trust between us and the public that we serve. This Privacy Statement provides that explanation. We reserve the right to change this Privacy Statement from time to time consistent with applicable privacy laws.

See our lending partner WebBank’s privacy policy here.

In the course of our business, we may collect Personal Information about you from the following sources:

- From applications or other forms we receive from you or your authorized representative

- From your transactions with, or from the services performed by, us, our affiliates, or others

- From our internet web sites

- From the public records maintained by governmental entities that we either obtain directly from those entities, or from our affiliates or others

- From consumer or other reporting agencies

Our Policies Regarding the Protection of the Confidentiality and Security of Your Personal Information

We maintain physical, electronic and procedural safeguards to protect your Personal Information from unauthorized access or intrusion. We limit access to the Personal Information only to those employees, contractors and agents who need such access in connection with providing products or services to you or for other legitimate business purposes. We will at all times comply with all laws and regulations to which we are subject regarding the collection, use and disclosure of individually identifiable Information.

Our Policies and Practices Regarding the Sharing of Your Personal Information

We may share your Personal Information with our affiliates. We also may disclose your Personal Information to:

- Agents, brokers or representatives to provide you with services you have requested

- Third-party contractors or service providers who provide services or perform marketing or other functions on our behalf

- Governmental entities to meet our legal requirements connected to the collection, retention and disclosure of individually identifiable

- Information, such as tax reporting or identification of money laundering

- Law enforcement in connection with investigations, or civil or criminal subpoenas or court orders

In addition, we will disclose your Personal Information when you direct or give us permission, when we are required by law to do so, or when we suspect fraudulent or criminal activities. We also may disclose your Personal Information when otherwise permitted by applicable privacy laws such as, for example, when disclosure is needed to enforce our rights arising out of any agreement, transaction or relationship with you.

Certain states afford you the right to access your Personal Information and, under certain circumstances, to find out to whom your Personal Information has been disclosed. Also, certain states and the Safe Harbor principles afford you the right to request correction, amendment or deletion of your Personal Information. We reserve the right, where permitted by law, to charge a reasonable fee to cover the costs incurred in responding to such requests.

All requests must be made in writing to the following address:

440 Monticello Ave

Ste 1802 PMB 61161

Norfolk, VA 23510

1. Policy Overview

This document (“Policy”) governs the oversight of the whistleblower process utilized by Lane Health in connection with protecting individuals who report activities believed to be illegal, dishonest, unethical, or otherwise improper.

1.1. Purpose

The purpose of the Policy is to ensure that the risks related to whistleblower activities are understood and managed in a systematic fashion that is compliant with Lane Health policy, applicable laws, regulations and guidance, and serves the best interests of Lane Health, shareholders and customers.

1.2. Scope

This Policy applies to all report activities believed to be illegal, dishonest, unethical, or otherwise improper.

1.3. Definitions

The following definition should be used when reviewing this policy:

Whistleblower is defined by this policy as an employee who reports, to one or more of the parties specified in this policy, an activity that he/she considers to be illegal, dishonest, unethical, or otherwise improper.

Employee or public employee means a person who performs a service for wages or other remuneration under a contract of hire, written or oral, express, or implied, for the district.

Matter of public concern means:

- a violation of a state, federal, or municipal law, regulation, or ordinance;

- a danger to public health or safety; and/or

- gross mismanagement, substantial waste of funds, or a clear abuse of authority.

1.4. Compliance

Lane Health will comply with all applicable laws, regulations and guidance pertaining to whistleblowers for regulated financial institutions.

2. Program Governance

See the CMS Policy for information related to Program Governance, including roles and responsibilities.

3. Policy Elements

The expectation and guidance shown below constitute a high-level overview of the standards Lane Health will use when made aware of potential whistleblower complaints.

5.1 General

- The organization will not retaliate against a whistleblower. This includes, but is not limited to, protection from retaliation in the form of an adverse employment action such as termination, compensation decreases, or poor work assignments and threats of physical harm. Any whistleblower who believes he/she is being retaliated against must contact the Chief Compliance Officer immediately. The right of a whistleblower for protection against retaliation does not include immunity for any personal wrongdoing that is alleged and investigated.

- Whistleblower protections are provided in two important areas: confidentiality and retaliation. Insofar as possible, the confidentiality of the whistleblower will be maintained. However, identity may have to be disclosed to conduct a thorough investigation, to comply with the law, and to provide accused individuals their legal rights of defense.

- Individuals protected include:

- the employee, or a person acting on behalf of the employee, who reports to a public body or is about to report to a public body a matter of public concern; or

- the employee who participates in a court action, an investigation, a hearing, or an inquiry held by a public body on a matter of public concern.

- The organization may not discharge, threaten, or otherwise discriminate against an employee regarding the employee’s compensation, terms, conditions, location, or privileges of employment.

- The organization may not disqualify an employee or other person who brings a matter of public concern, or participates in a proceeding connected with a matter of public concern, before a public body or court, because of the report or participation, from eligibility to bid on contracts with the organization; receive land under a district ordinance; or receive another right, privilege, or benefit.

- The provisions of this policy do not:

- require the organization to compensate an employee for participation in a court action or in an investigation, hearing, or inquiry by a public body;

- prohibit the organization from compensating an employee for participation in a court action or in an investigation, hearing, or inquiry by a public body;

- authorize the disclosure of information that is legally required to be kept confidential; or

- diminish or impair the rights of an employee under a collective bargaining agreement.

- Limitation to protections:

- A person is not entitled to the protections under this policy unless he or she reasonably believes that the information reported is, or is about to become, a matter of public concern; and reports the information in good faith.

- A person is entitled to the protections under this policy only if the matter of public concern is not the result of conduct by the individual seeking protection, unless it is the result of conduct by the person that was required by his or her employer.

- Before an employee initiates a report to a public body on a matter of public concern under this policy, the employee shall submit a written report concerning the matter to the organization’s Chief Compliance Officer. However, the employee is not required to submit a written report if he or she believes with reasonable certainty that the activity, policy, or practice is already known to the Chief Compliance Officer; or that an emergency is involved.

5.2 Procedures

- If an employee has knowledge of or a concern of illegal or dishonest/fraudulent activity, the employee is to contact his/her immediate supervisor or the Chief Compliance Officer. All reports or concerns of illegal and dishonest activities will be promptly submitted by the receiving supervisor to the Chief Compliance Officer, who is responsible for investigating and coordinating any necessary corrective action. Any concerns involving the Chief Compliance Officer should be reported to the Chief Executive Officer.

- The whistleblower is not responsible for investigating the alleged illegal or dishonest activity, or for determining fault or corrective measures; appropriate management officials are charged with these responsibilities.

- Examples of illegal or dishonest activities include violations of federal, state, or local laws; billing for services not performed or for goods not delivered; and other fraudulent financial reporting. The employee must exercise sound judgment to avoid baseless allegations. An employee who intentionally files a false report of wrongdoing will be subject to disciplinary action.

6. Policy Operations

See associated procedures for additional requirements related to the day-to-day processes to ensure compliance with this Policy.

7. Policy Exceptions

See the CMS Policy for information related to Policy Exceptions.

Submitting whistleblower claims:Claims can be submitted to a restricted email: whistleblower@lanehealth.com

Guiding Principles

At Lane Health, we strive to provide services to our customers in a secure and responsible manner. As we built an industry only pre-tax and post-tax lending platform, HSA and other benefits administration solutions, as well as customer facing web and mobile interfaces, we’ve done it with security built into the architecture and our processes. Lane Health is committed to protecting the confidential information, data integrity, and transparency of our operations.

This page goes over our approach to securing PII against cyber-attacks—combining secure design and quality engineering practices, developing strong connections with the cybersecurity community, and developing a world-class Risk & Compliance process.

Cybersecurity

Lane Health follows industry accepted best practices when it comes to security. We established joined internal operations between SREs, NOC and Software Engineering teams to implement and deploy controls designed to secure the perimeter of our systems and minimize the threat of attacks.

Fraud Prevention

Our Fraud Prevention Operation is employing the best practices of fraud prevention and cybersecurity monitoring through rigorous security training and systematic monitoring to identify and secure the data of our clients.

Compliance

Lane Health Compliance department operates at the enterprise level: managing operational, financial, and security risks for the entire company. They interface with internal and external audit entities and implement state of the industry transparent operation.

Incident Management and Communication

Lane Health created a robust Incident Management and Communication policy that was certified by our banking institution.

Privacy

Lane Health developed the Data Privacy policy based on the detailed analysis of government regulations and validated by rigorous audits. Our state-of-the-art technology teams build systems with security and privacy in mind. The Privacy Policy can be found here: /resources#nav-documents

Lane Health Security Features:

- Regular 3rd-party vulnerability scanning and testing

- Dynamic capacity and scalability management

- Intrusion detection monitoring

- Multiple redundant data centers

- Annual review of policies

- Call centers with high responsiveness SLA

- All employees and contractors with access to Lane Health systems and data complete mandatory compliance, privacy, and security training as part of hiring process

- Third party verification of cloud-native architecture for Health Insurance Portability and Accountability Act (HIPAA) compliance

- Background checks for US employees with access to PII

Security and Vulnerability Reporting

Lane Health encourages security researchers to report discovered issues with Lane Health systems by reporting them to securityreporting@lanehealth.com.